No-Nonsense Sustainability

How to secure finance, talent and customers in the earth-first economy

Download PDFHow to secure finance, talent and customers in the earth-first economy

Download PDF“Employees, customers and investors want to see business active in preserving the planet for future generations not exploitation.“

While world leaders at COP26 haggled over measures to keep their economies on track to meet Paris Agreement targets, businesses were already being driven by a trio of forces outstripping the power of any legislation, past or future. Those forces are their stakeholders: employees, investors and customers. These groups, rather than government regulations, will power the shift to sustainable business models. Whether due to enlightened self-interest or market forces, business leaders are being moved to respond.

In the stakeholder-centric model, environmental, social and governance (ESG) concerns are overtaking the profit motive. Employees, customers and investors want to see businesses active in preserving the planet for future generations, not exploitation. Failure to pursue net zero and address the climate crisis in the near future will see companies fail, as they lose the war for talent, the ability to access investments, and customers. The ones that win will be those that embrace the opportunities presented by climate change, and think in terms of Participation, Proof and Promotion when considering their sustainability agenda.

Positive Momentum has been mapping the sustainable business landscape to see how companies are working to survive – and thrive – in the earth-first economy. We have spoken to leaders of businesses in different industries from across the globe, and surveyed how their key stakeholders view the environmental challenge. Our data reveals that organisations are recognising that their environmental performance is central to attracting talent, safeguarding access to investment, and preserving and boosting sales – but there is more work to do.

Leadership plays a key role in closing the gap between ESG commitments made and actions delivered. Their ability to attract a climate-conscious millennial workforce; to secure financing via earth-first investments; and help B2B customers to achieve a net-zero supply chain depend upon it.

In this report, we will investigate the new approach that is needed, considering, in turn, the key themes of Participation, Proof and Promotion. With these in mind, businesses can win the hearts and minds of their primary stakeholders. We will also outline the opportunity gap waiting to be filled by those that get it right, and offer our best advice on how to navigate the sustainability challenge.

The data shared in this report is based on responses from approximately 100 businesses, representing a mix of size, ownership structure and industrial sector. Each interviewee was assessed for their current role and asked a set of expertise-specific questions to gather the best knowledge about the workings of their employer. Respondents were asked questions about either leadership, fundraising and investor relations, HR, or winning customers.

Bunzl

Alcatel-Lucent Enterprise

Cynergy Bank

of organisations have been refused funding because of environmental concerns

of businesses have voluntarily joined an environmentally focused certification, such as the B Corporation movement

of respondents either strongly agreed or tended to agree that environmental performance is an important factor in the recruitment process

of businesses discuss environmental and sustainability performance during recruitment interviews

“Having a best-in-class environmental policy will help a company grow by more than 15% per year…”

How to use this report to make the most of the environmental challenge

of business leaders believe environment and sustainability should be used to create purpose among staff

To make the most of millennials’ passion for the environment, see this section

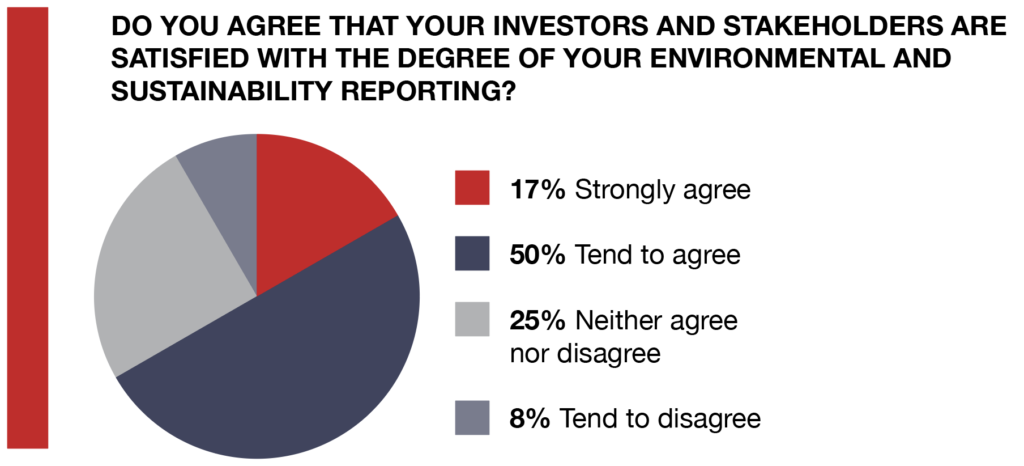

of respondents strongly agree that investors and stakeholders are satisfied with the degree of their environmental and sustainability reporting.

To find out how to create a credible ESG performance management system, see this section

The majority of businesses focus on Scopes 1 and 2 emissions in their journey to net zero

For help in setting up a credible plan for all emissions, and using this to engage and win customers, see this section

“Failure to pursue net zero and address the climate crisis in the near future will see companies fail, as they lose the war for talent, the ability to access investments, and customers”

Climate change and environmental risks are considered by global CEOs to be the number-one risk factor facing their organisations, according to research by KPMG. But leaders may not realise those risks extend beyond navigating the shift to a low-carbon economy and into their ability to attract skilled workers. In Marsh & McLennan’s 2020 report, ESG as a Workforce Strategy, among young talent, the most attractive employers have a 25% better ESG performance than average employers, directly linking sustainability to recruitment.

Competition for talent is getting fiercer. Research by McKinsey & Co reveals that one third of senior leaders see identifying and securing talent as their most significant challenge. The digitisation of the economy means there are more organisations fishing in the pool, with every industry needing analysts, engineers and developers, and technical talent having their pick of employers. Similarly, the Covid-19 pandemic has caused many people to re-evaluate how they live, and sustainability has surfaced as a major driver in their decision-making.

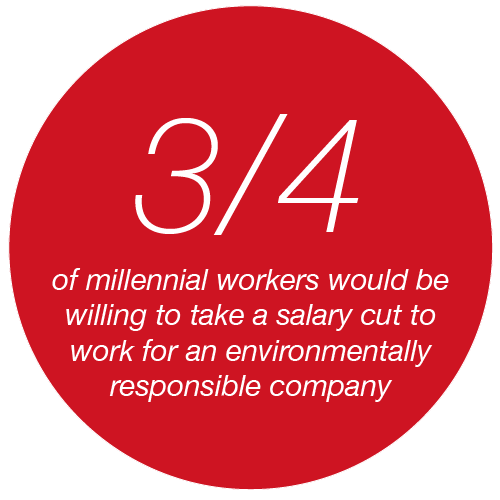

Add to this the fact that, by 2025, millennials will form 75% of the world’s workforce. Sustainability is so important to this generation that three quarters of them would be willing to take a salary cut to work for an environmentally responsible company, according to Fast Company research. Of 1,000 US employees surveyed, over 70% said they would choose a company with a strong environmental strategy over one without, with nearly 40% of millennials having already selected an employer for this reason.

“Existing employees and prospective employees see this as core,” says Diana Breeze, Director of Group HR at Bunzl. “There’s been an awful lot written about the search for meaning and purpose in organisations and to existing employees, but also potentially prospective employees of yours as well. Environmental sustainability is absolutely at the heart of that.”

Companies competing for the best talent need to offer more than pay and perks – they need to offer purpose. They must prove and promote their sustainability credentials, or face losing the war for talent to their greener competitors.

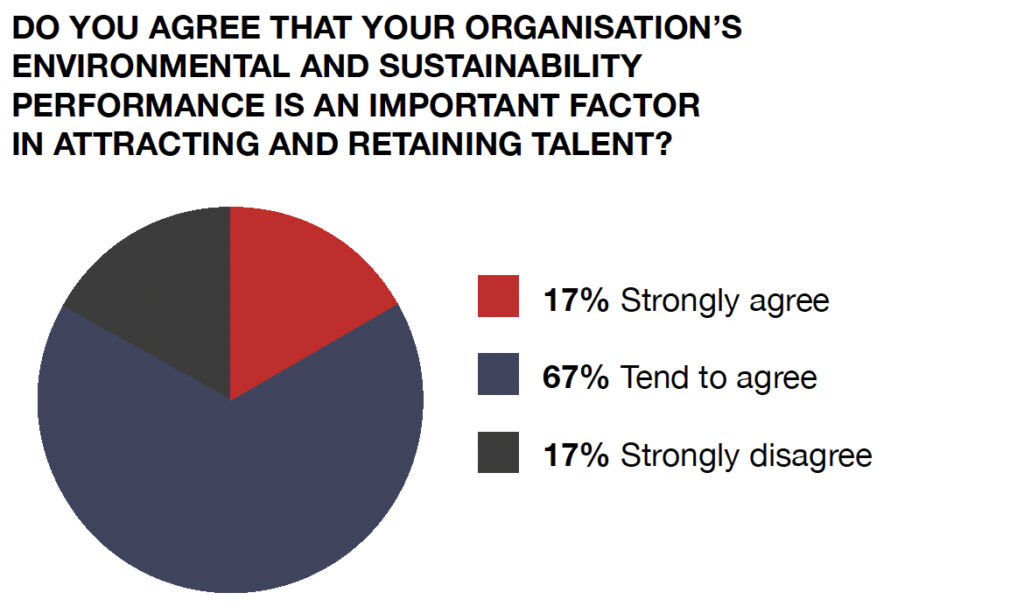

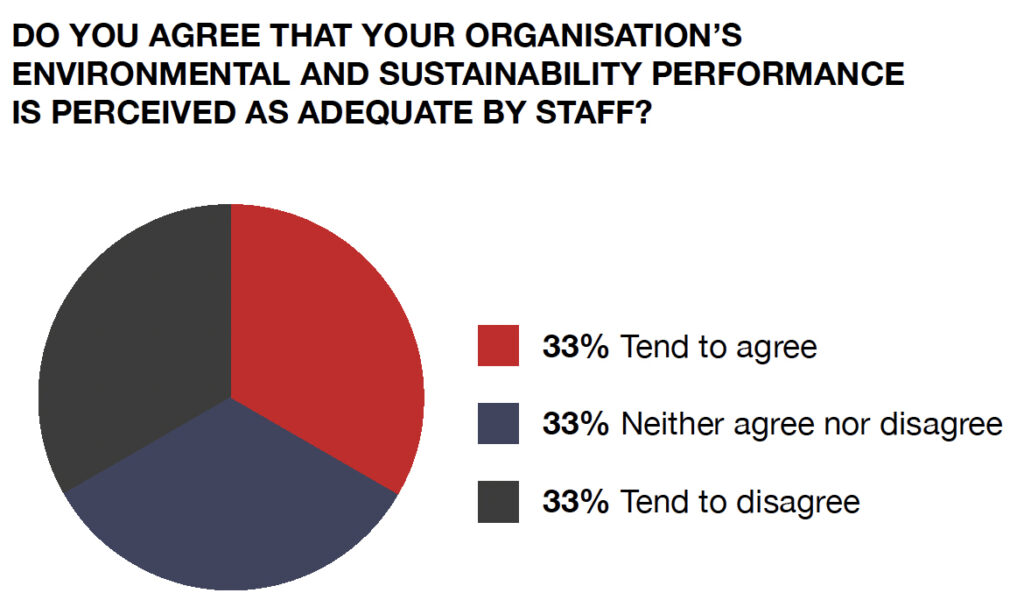

People want their climate priorities to match those of their employer. It’s a message not lost on today’s leaders. In our research, more than four fifths (84%) of respondents say their organisation’s environmental and sustainability performance is a central factor in attracting and retaining talent. Nonetheless, one third say staff judge their current environmental actions to be below adequate, while another 33% remain neutral on the issue.

To combat this, a firm’s sustainability strategy needs to be inclusive and authentic. Potential talent wants to see genuine action being taken and have the opportunity to actively tackle the climate crisis within the workplace.

“There is a big focus at the moment on well-being and mental health, which has been prompted partly by the pandemic,” adds Breeze. “By engaging employees in activities like volunteering with local environmental projects – the ones we sponsor, engage with and donate to – they get a sense of connection with the organisation and a real sense of well-being, more than it ever has done.”

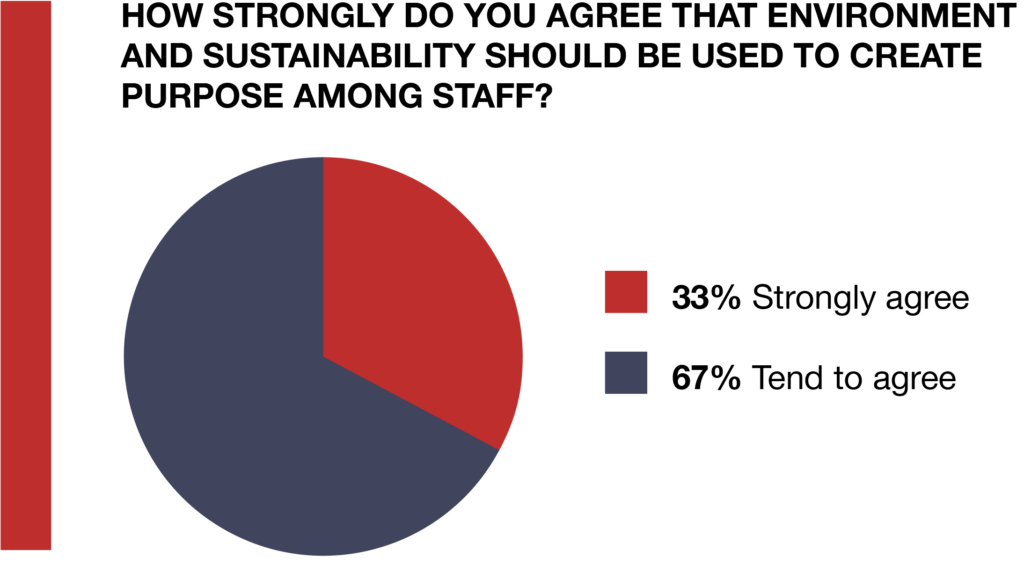

Engagement means employees knowing their contributions are recognised and considered. Our survey shows that 67% of business leaders think environment and sustainability should be used to create purpose among staff, with 33% strongly agreeing. This can be done through regular sessions via live channels, using tools such as Teams and Slack, or anonymous platforms like Suggestion Ox or Slido. An awards programme creates organisation-wide recognition and rewards for the best ideas and team members who drive the most positive change.

“A firm’s sustainability strategy needs to be inclusive and authentic. Potential talent wants to see genuine action being taken“

Organisations could consider setting up cross-functional sustainability teams with representatives from every level of seniority, down to the most junior. These teams would regularly review every aspect of the organisation’s use of resources to cut waste and shift to more sustainable options.

ESG activity needs to be prominent throughout the employee experience, even before they join. At interview stage, questions around sustainability and the candidate’s own priorities will clearly advertise the importance given to it by the company. Likewise, the company’s sustainability position should be highlighted in both job ads and role profiles, so that every employee understands that it’s a key responsibility.

“We’ve put sustainability at the heart of our employment brand,” adds Breeze. “We know how important it is to prospective, particularly younger, talent for us to have a robust sustainability strategy. It’s a hygiene factor. Without it you won’t be able to hire talented people into your organisation. It’s just as important as the remuneration package these days.”

Environmental consciousness should be a continuing theme on the employee journey, through internal learning and development, and external thought leaders delivering workshops and advice. Ongoing support can be provided via visual messaging on initiatives and progress towards targets in high-traffic areas, plus reminders around limiting stationery, energy and water use.

Employees cannot make the change alone, and the sustainability agenda needs to percolate from the top down, championed by the entire C-suite. The majority of those we surveyed, many in C-suite roles, indicate that embedding environmental sustainability into their organisation is a key part of their future strategy. To prove the point, leaders’ performance reviews and KPIs should, perhaps, be linked to sustainability targets.

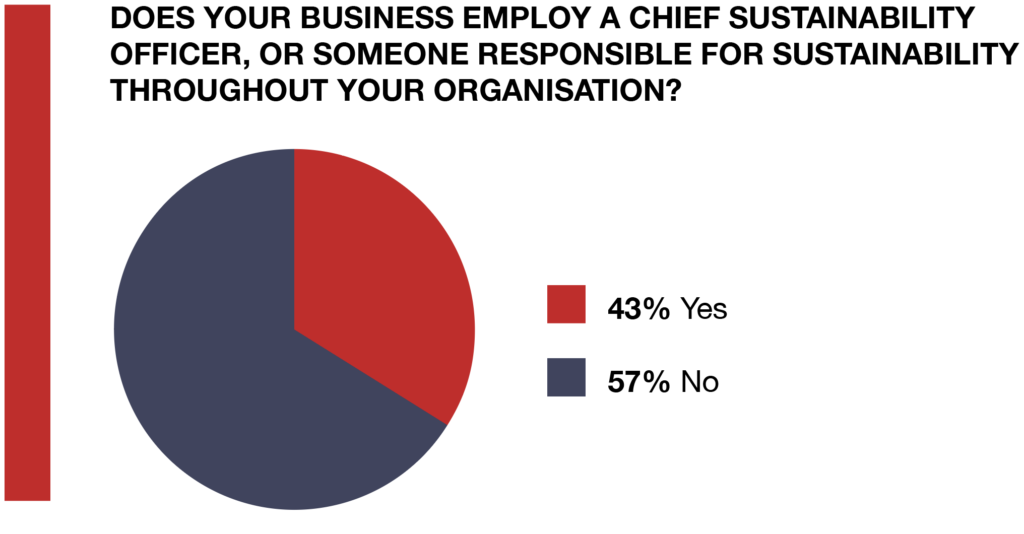

“It is in every member of the C-suite’s remit to contribute in this area,” says James Davis, Partner at Positive Momentum. “After all, it will be the C-suite’s leadership, messaging, cadence and ‘can-do’ attitude that make all the difference to the future of their businesses and also the environment.” Ideally, there should also be an individual leading the charge – although more than half (57%) of our respondents say there is no dedicated sustainability role within their organisation.

Having an ESG lead makes it easier to engage staff in the organisation’s commitment to reaching net zero. With businesses around the globe attempting to navigate labour shortages, now is the time to step up. The good news is that linking sustainability and employee purpose isn’t difficult. Put even some of these actions in place and you will be well positioned in the intensifying battle for the best talent.

One of the biggest returns on your investment in sustainability is the “return on involvement” of your people. Involve people in sustainability and they will make you more money, add value to your brand and create a culture that performs.

Actively engage teams and individuals in your journey to a more sustainable business, giving them agency over what the organisation is doing to reach net zero. Let them participate in sustainability activity and encourage them to innovate. Give them a meaningful platform to shape the business’s direction, and the tools to do it.

Importantly, focus on three areas:

Your brand story needs to speak to the concerns and aspirations of the people who you need to attract, develop and retain.

Climate change, nature/biodiversity loss and social equality will be key issues over the coming decade. Commit to making a difference and then work this into both the things you do for customers and the way you do business. This means getting the C-suite invested in the sustainability agenda, and putting it at the heart of boardroom decisions.

Companies need to earn credibility. Engage the “critical friend” objectivity of an external consultancy to provide objective ESG assessments. These rate your ESG activity against that of your competitors. By proving the business is delivering on its promises, ESG rankings can help to attract and retain talent.

Stakeholder capitalism, with its focus on long-term value creation for all, is on the rise. The growing influence of all stakeholders – not just shareholders – is making businesses more accountable on ESG issues. As a result, the ability of companies to raise finance has become intrinsically linked to their sustainability credentials.

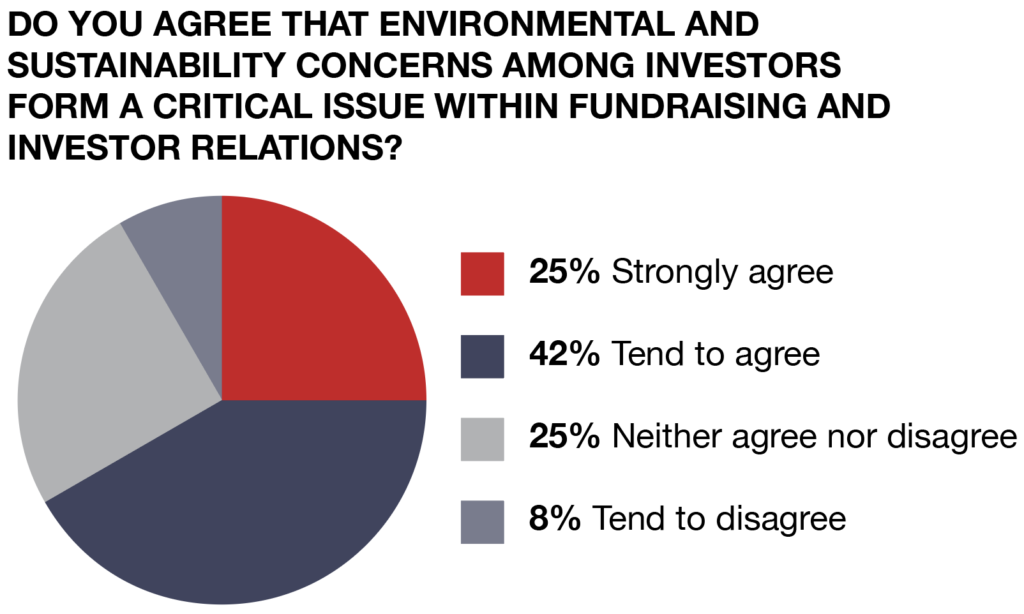

The BNP Paribas ESG Global Survey 2021 found that 46% of asset managers cite external stakeholder requirements as the top motivation for ESG investing, while our own research reveals that, for two thirds of companies, environmental and sustainability concerns are critical within investor relations. Companies looking for investment need to improve their ESG ratings, hence the growing number of ESG reporting standards, both regulatory and voluntary, being signed up to.

FTSE 100 companies can already expect to report to more than 10 organisations monitoring corporate ESG performance. Some, like Share Action, engage with shareholders to encourage investment for social and environmental progress. Others act as ratings agencies, publishing businesses’ ESG risk scores. And the COP26 climate change summit saw the new International Sustainability Standards Board (ISSB) initiate development of globally recognised ESG disclosure standards.

For publicly listed companies eager to improve their share prices, the need for good ESG rankings is already acute. Institutional investors are focusing in on earth-first investments, which protect the planet as well as portfolios. Between January and November 2020, ETFs and mutual funds invested $288bn globally in sustainable assets – a 96% increase on all of 2019. At COP26, 450 financial institutions holding 40% of global financial assets under management – approximating $130trn – committed to net zero. Larry Fink, CEO of BlackRock, underscored this change in his 2021 letter to CEOs. Stating that “the climate transition presents a historic investment opportunity”, he called for a “tectonic shift” toward net zero, citing the link between sustainability and corporate performance.

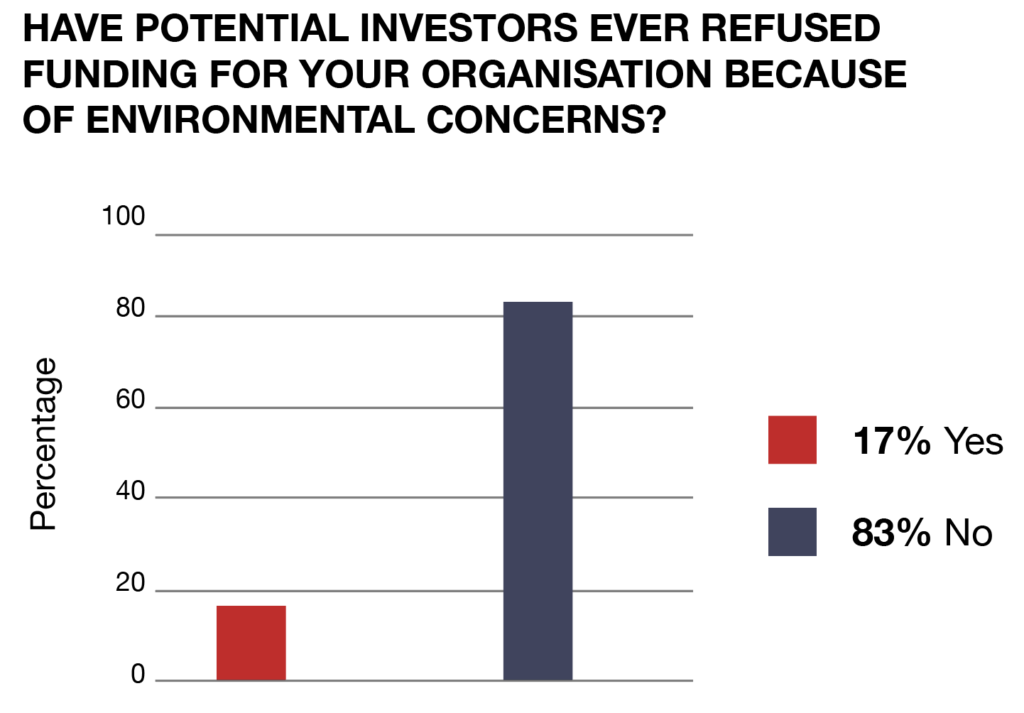

Across the globe, financial institutions are also responding to regulation on which organisations they can lend to, with environmental responsibility high on the list of criteria. Sources of cheap finance for overdrafts, loans for equipment purchases, and even short-term cash-flow injections are becoming dependent on a demonstrable sustainability strategy. In our research, 17% of respondents report being refused funding by banks owing to environmental concerns.

Smaller companies, too, are also starting to feel the impact, according to Francesca Hampton, CFO at Cynergy Bank, whose clients are predominantly SMEs. “While a lot of the new regulation is still being finalised, UK financial institutions need strong transition plans. At the moment, it’s all about our disclosures, our governance and our strategy,” she says. “We’re still at the beginning of the journey, but it’s moving fast and will impact the way all businesses carry out their services. We all have to say what we intend to do, and then we have to deliver it.”

With the introduction of the ISSB, announced at COP26, Hampton adds, banks will have to be more specific in their disclosures, while the UK’s Financial Conduct Authority (FCA) and the European Banking Authority (EBA) also intend to add more pressure. In the UK, it is the bank’s board that will be accountable for its transition to net zero, through the Senior Managers and Certification Regime.

“For SMEs, this is going to be a transitional period, and it comes at a time when we have political uncertainty, technological advancement, and societal change all happening at the same time,” says Hampton. “The regulation coming on climate change will demand resource and intellectual thought, and banks will need to help deliver what the country needs in terms of climate change.” At some point, adds Hampton, banks simply won’t be allowed to lend to businesses that cannot fulfil their promises on climate change or to ones that have inadequate efficiency ratios.

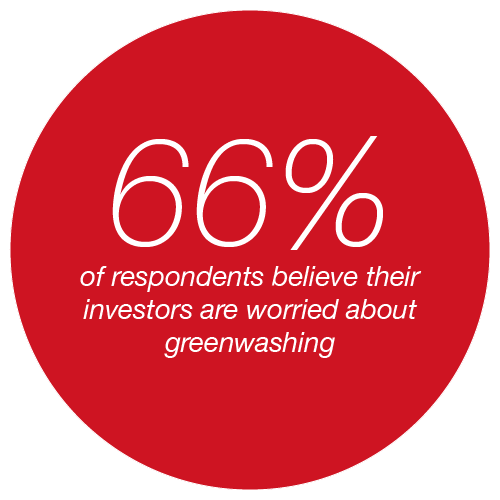

The need for investment and financing is driving ESG reporting. Businesses need to be able to prove they are serious about sustainability, and avoid any taint of greenwashing in their corporate communications. Environmental metrics should be transparent, comparable and verifiable – and also show that the business is making progress on sustainability.

This is an immediate imperative, but only 17% of respondents to our survey are convinced that their stakeholders are satisfied with their environmental and sustainability reporting. Meanwhile, one third feel unsure or disagree that stakeholders are receiving the ESG data they require. Our research also suggests that two thirds believe investors remain concerned about greenwashing.

According to a 2021 report from BNP Paribas, data – its quality, consistency and availability – is the primary barrier to ESG integration cited by 59% of asset managers, 28% of whom flagged conflicting ESG ratings as the top challenge. To rectify this, businesses need to understand their ESG position and have the tools to generate ESG intelligence reports to promote their sustainability credentials to stakeholders.

While awaiting global standards from the ISSB, organisations can sign up to relevant ESG indexes and reporting standards. These might include the ISO 14000 environmental management standards, or rankings provided by agencies including MSCI and Sustainalytics. Even within voluntary frameworks, businesses should be rigorous with their data, ensuring it is verifiable, quantifiable, and will stand up to external scrutiny. Then, when national and international regulations – such as the EU’s 2022 Sustainable Finance Disclosure Regulation – go live, they will be prepared.

“Businesses should be rigorous with their data, ensuring it is verifiable, quantifiable, and will stand up to external scrutiny“

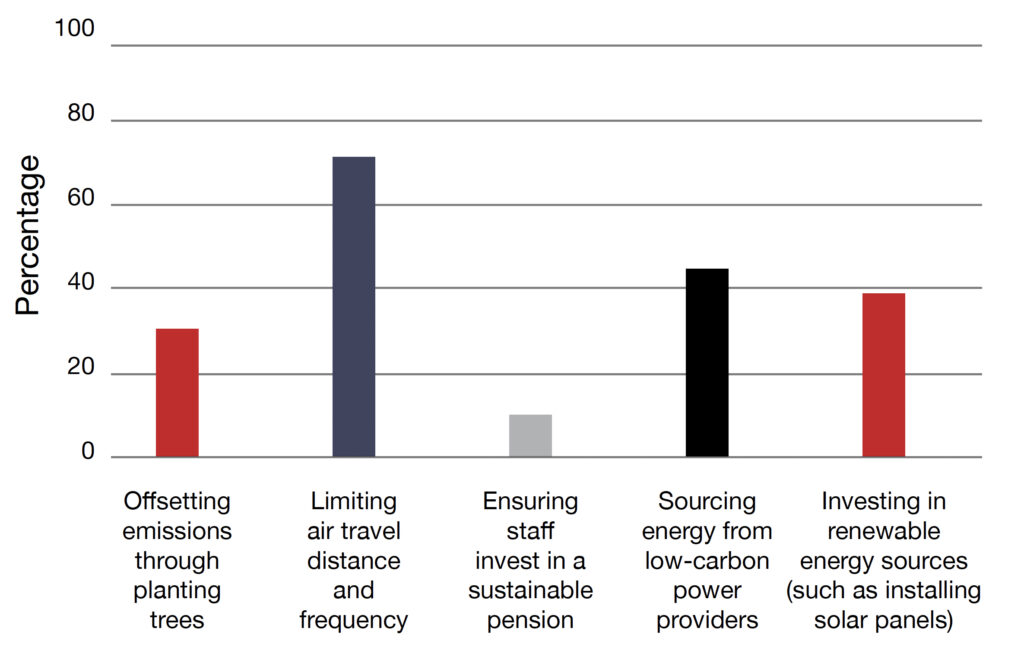

In the sphere of ESG compliance, leaders need to recognise how fast the ground is shifting. For those who feel they are lagging behind what stakeholders expect, identifying quick wins can help. “A number of respondents are choosing to offset unavoidable emissions through external emissions reductions, such as tree planting,” says Simon Brown, Partner at Positive Momentum. “Studies carried out by the International Carbon Reduction and Offset Alliance (ICROA) indicate companies that offset typically invest more in energy efficiency and renewables, too.”

But don’t consider that ‘job done’. “It’s likely the rules around offsetting will be reviewed soon,” says Brown. “Carbon removal projects, either nature-based or using technology that permanently removes CO2 from the atmosphere, will be seen as more aligned to Paris Agreement targets. The cost of these will be much higher than the current cost of offsets, so businesses need to develop long-term strategies to integrate them into their net-zero plans.”

Whatever sustainability strategy the business chooses, finance leadership in particular is in a position to drive sustainability, not just in terms of investment and raising finance, but in setting targets, creating monitoring systems and equipping every department to rise to the climate challenge. Solutions by numbers are the way out of this crisis, and the CFO has as crucial a role in this as the Chief Sustainability Officer.

One of the headlines from COP26 was the commitment to net zero by approximately 450 financial institutions with assets under management of more than $130trn. Money isn’t the problem, but securing it requires robust ESG data. Start by creating an ESG performance management system, following the 12 steps (See this illustration). This sustainability dashboard provides oversight of the relevant information.

In a rapidly expanding industry, there are a host of providers, such as Alva and Signal AI, offering bespoke and off-the-peg ESG intelligence solutions, so seek advice from a consultancy such as ourselves on the best fit for your business. Interrogate the solution’s data offering to see if it surfaces the right metrics for your KPIs, is industry specific, if it provides competitor oversight, and how the dashboard can be tailored to different users.

Once established, the performance management system acts as a ‘centre of truth’, providing ESG intelligence to engage internal stakeholders, including investors, customers and staff, and delivering transparent, credible information to external stakeholders such as regulatory bodies.

In putting together your ESG data, remember the following:

Lenders or investors need to trust the business they are financing and this starts with transparency in reporting both financial and ESG performance. A key outcome at COP26 was an accounting standard for ESG, announced by the IFRS (International Sustainability Standards Board), adding to others such as the Global Reporting Initiative (GRI) Standards and the Science-based Targets initiative (SBTi) Net-Zero Standard. Pick the standard(s) relevant to your business so lenders or investors trust your data/information.

Most businesses are accustomed to disclosing risks to their investors and lenders to demonstrate that they understand and can mitigate them. ESG augments the nature of risk that these people are interested in, so use the correct frameworks for disclosure. You may need to learn some of the technicalities to engage with risks such as ‘climate- or nature-related financial risks’, ‘ethical resilience’ and ‘social licence to operate’ to engage confidently.

Well-written, expertly informed and clearly committed polices that cover the most important aspects of ESG risk and performance show investors that you practise what you preach. Make sure these policies make sense in the context of your business, and that there are clear signs that these policies are actioned.

A report by Amazon Business revealed that 39% of B2B purchasers saw ‘improving sustainability in purchasing decisions’ as their highest priority in 2021. Meanwhile, research by McKinsey & Co found that more than 70% of customers surveyed on purchases in multiple industries – including automotive, building, electronics and packaging – would pay 5% more for a green product if it met the same performance standards as a non-green alternative.

And buyers aren’t only motivated by doing the right thing. Legislation is also driving business purchasing to become more sustainable. In the UK, for example, all public sector contract decisions now have a 10% weighting that relates to ESG factors. The commercial sector is fast following suit, increasingly requiring tender responses to include ESG commitments.

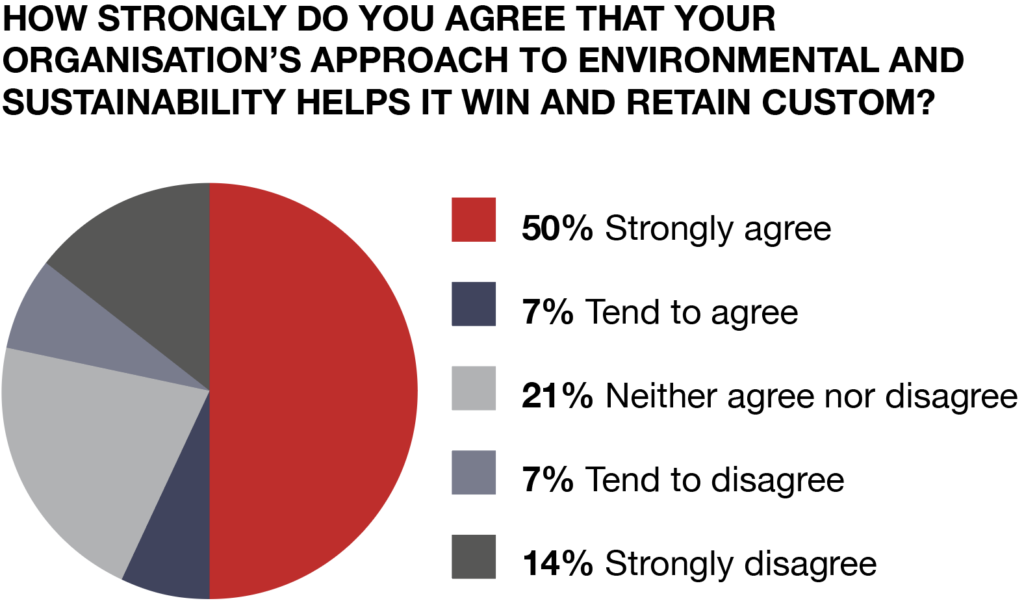

These trends send a message to B2B executives that customers want to see them actively pursuing sustainable operations. Half of those surveyed in our research are convinced that their organisation’s approach to sustainability helps the business win and retain custom. We also found that a significant 43% of respondents believe a best-in-class environmental policy will help the business grow by more than 15% per year, which means embedding and promoting sustainability considerations at every stage of the client journey, from product development to customer support.

It’s an attitude that is mirrored by Rukmini Glanard, EVP Global Sales, Services and Marketing at Alcatel-Lucent Enterprise (ALE), which has environmental sustainability as one of its four corporate social responsibility (CSR) pillars: “The topic is definitely a customer and partner conversation, that appeared more regularly in 2021, as governments and media, in meetings such as COP26, continue to highlight greater action needed.”

As a private company, ALE faces little to no obligation to report its CSR activities, yet ALE does take action to report and publish activity; during 2020, it witnessed a 20% increase in new bid requests that include material questions on CSR. Indications from 2021 suggest this has increased to 40%.

“For environmental sustainability, our focus is to try to go beyond country regulation compliance and stay ahead of requirements – which is more and more difficult,” adds Glanard. “It is important that our R&D and development partners design with compliant components and materials and that ALE carries out environmental sample testing of these as part of the product certification cycle.”

There are myriad ways businesses can demonstrate to potential and existing customers that they have a strong sustainability focus.

In client satisfaction surveys, asking questions around how customers respond to environmental efforts will clearly advertise the steps being taken. Establishing a client sustainability advisory board invites customers to participate in ESG policy, and will garner diverse input.

Ensure that all employees are on board with the strategy. Sales teams, bid management teams, and service and support teams also need to be knowledgeable about ESG trends in their marketplaces, and the company’s sustainability measures, to prepare them for client dialogue around the subject. “Ensure you make this part of your company culture, and not a ‘nice to have’,” adds Glanard.

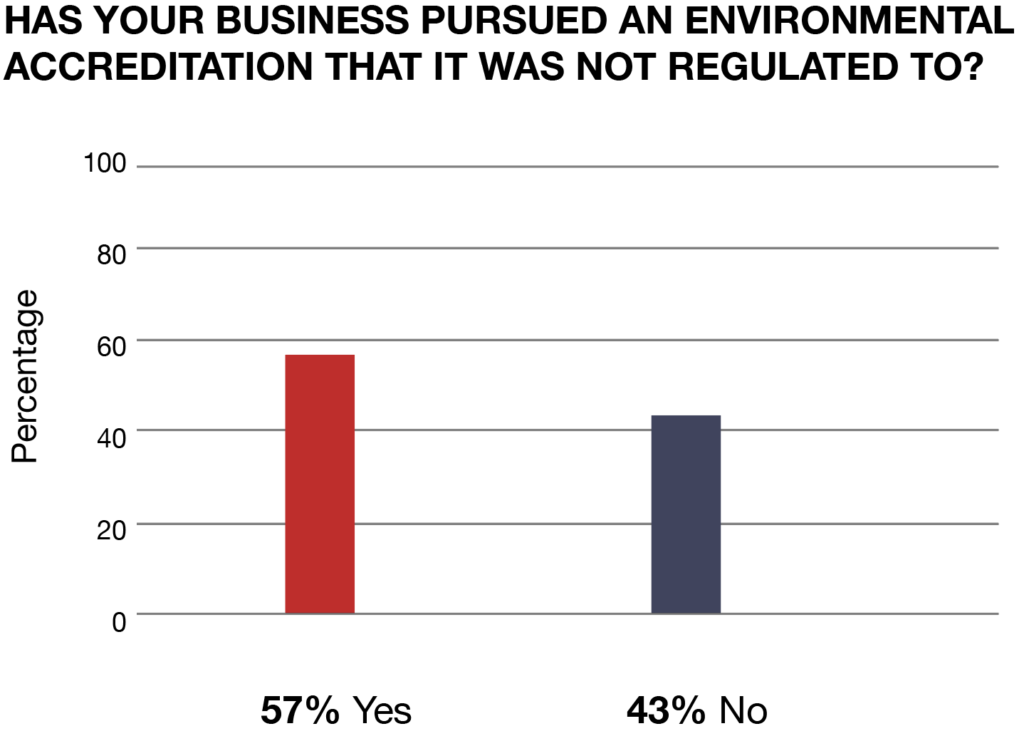

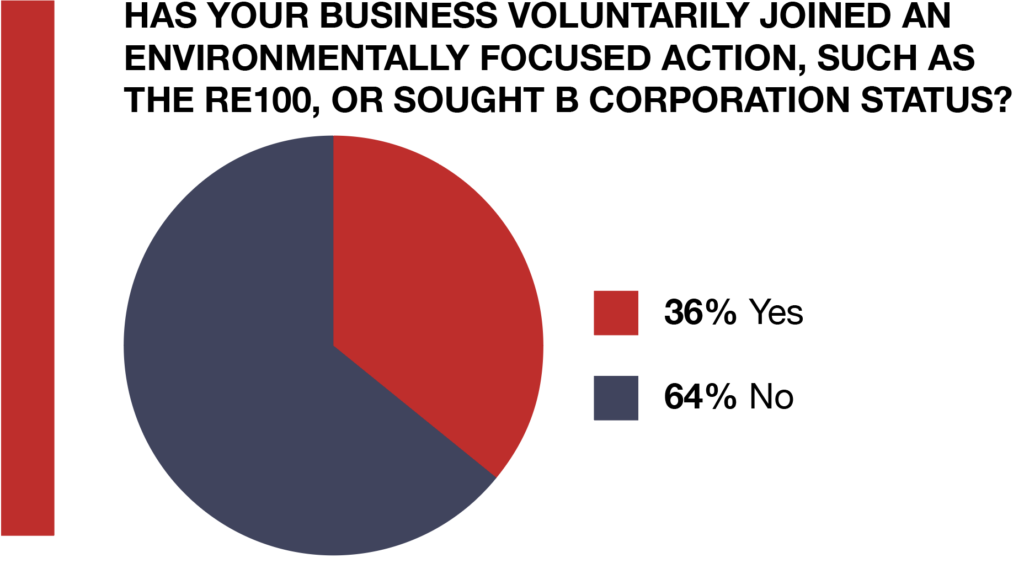

Sustainability accreditations can be a powerful way to promote ESG commitments. Our research shows that 57% of businesses have pursued an environmental accreditation that was not a regulatory requirement, while 36% have voluntarily joined an environmentally focused membership organisation, underlining the goodwill value of advertising sustainable business practices.

“Corporate comms should lead with verifiable statistics and set these numbers against the company’s sustainability targets and wider industry performance“

The higher the profile of the awarding institution, the greater the positive customer reaction. The RE100 group, for example, links over 300 large corporates that have committed to purchasing electricity only from renewable sources. Endorsed by environmental disclosure platform the CDP, its awards are internationally recognised.

Similarly respected is the B Corporation movement, which aims to build a “more inclusive and sustainable economy”. Its members meet the highest standards of verified social and environmental performance, public transparency and legal accountability to balance profit and purpose.

Businesses that have succeeded in gaining sustainability accreditations should promote their achievement across all marketing channels, with prominent positioning on company websites, email signatures, press releases and online product overviews. All staff need to be trained in what the accreditation means and the steps taken to achieve it, and able to communicate that information.

High-profile greenwashing scandals have led to growing cynicism around unproven claims of corporate environmental conscientiousness. To rebuild that trust, corporate comms should lead with verifiable statistics and set these numbers against the company’s sustainability targets and wider industry performance. Organisations proactively supplying clients with sustainability data and dashboards to enable them to comply with regulations and achieve their own sustainability goals will win more contracts.

The power of environmental performance to attract customers can’t be overlooked. Progressive corporates looking to monitor and tackle their Scope 3 emissions – greenhouse gases emitted in your value chain as a result of activities from assets not owned or controlled directly by you – require suppliers to meet environmental and sustainability standards.

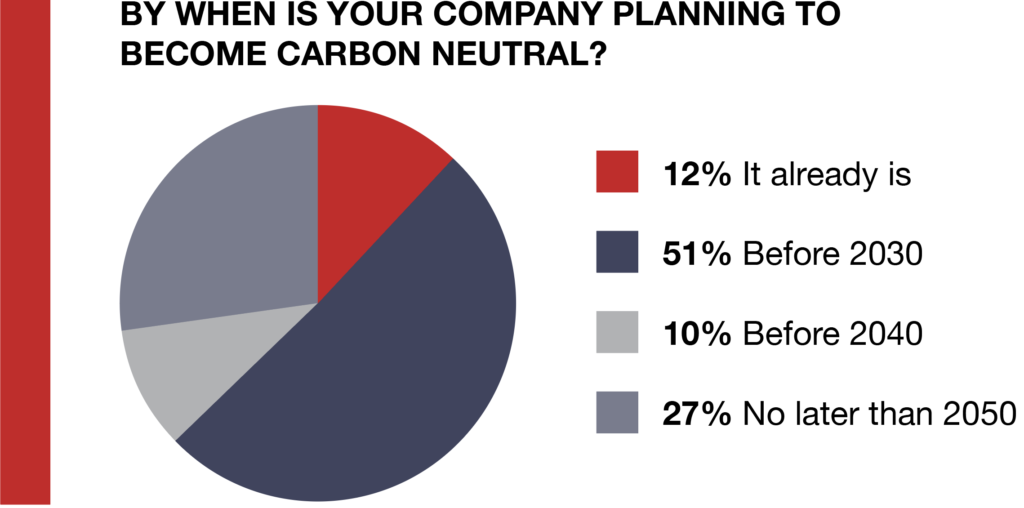

B2B leaders recognise the need to take action. Some 12% of the organisations we surveyed claim to be carbon neutral, and a further 51% plan to be so by 2030. “The majority of respondents are pursuing a climate and emissions reduction plan aligned with avoiding 2°C of global warming,” says Simon Brown, Partner at Positive Momentum. “Half of companies responding have a far more ambitious plan, linked to a 1.5°C warming relative to 1990 levels – the Paris Agreement aligned target.”

Businesses should be able to prove to customers that they can help them de-risk their supply chain, by demonstrating that they are a sustainable organisation. By taking action now, organisations can achieve first mover competitive advantage. If they wait, they will lose customers, both existing and potential, who require a greater ESG commitment from their suppliers.

“It will be the C-suite’s leadership, messaging, cadence and ‘can-do’ attitude that make all the difference to the future of their businesses and also the environment”

James Davis, Partner at Positive Momentum

There is a significant opportunity for B2B businesses in advertising their environmental credentials to customers. Climate-conscious millennials will soon be dominating buying decisions across the economy, impacting businesses both up and downstream. Training sales teams and tailoring marketing materials to speak to this audience will help you win these customers.

More involved, but no less effective, is to gain membership of a sustainability accreditation scheme that offers decision makers a shortcut to identifying whether a business is serious about its environmental footprint. If the scheme is rigorous and high profile, then your business can use its membership to learn from fellow members, and pursue excellence as part of a more progressive ecosystem. It will also provide a footing to talk about your environmental engagement at trade shows, with governmental bodies, and in wider marketing activities. Be bold in using your accreditation as a promotional tool.

What to consider:

You are part of your customers’ emissions footprint. A customer that sets a science-based target for their emissions will need to count your emissions too (under Scope 3). Having an exemplary record on sustainability will make it easier for customers to choose to work with you.

Add sustainability to your product/service/solution design criteria and work at it. Act like a Triodos Bank, or a Tesla fleet and seek better offerings that are inherently more sustainable and earn their price premium (while it lasts).

Accreditation simplifies all of the above for your customer and the hard-earned badges are worth more. Broad badges, such as B Corp, say something about your total business being a force for good and not just profit. Focused accreditation, such as the UN’s Race to Zero, show you are part of the transition to a key outcome, such as a low-carbon economy. If you strive to “earn the badge” and not just “tick the box”, then the accreditation you aim for will bring clarity of detail to what you should achieve.

As you have just read in this report, Participation, Proof and Promotion are vital to a business’s survival as the world moves towards net zero. But underpinning these ideas is the principle of an earth-first leader – and, indeed, earth-first employees, citizens and consumers.

Perhaps the hallmark of the earth-first mindset, aside from placing environment at the heart of business decisions and operations, is a deep understanding of how Participation, Promotion and Proof work together. At Positive Momentum we venture that the three are intimately connected such that their real value is captured in a virtuous circle of added value.

Participation – Taking actions, and inviting talent, customers and investors to lead environmental direction. Gives a sense of purpose and agency over tackling the climate crisis.

Proof – Showing you are credible and accountable for your actions on climate, and perform to a set of standards created by third parties. Further engages staff, customers and investors, enriching more participation, and inviting higher standards of proof.

Promotion – Making the most of your credible commitments and actions on environment to drive further engagement and participation.

Harnessing the virtuous circle captures the spirit of the certified B Corporations – and other movements like them. Throughout this research, you will have seen the B Corporation logo. In 2020, Positive Momentum decided to take a significant step towards reducing our social and environmental impact. As a boutique business consultant, we didn’t have a huge CO2 footprint to tackle, but we could join the global shift to redefine business success and build a more inclusive and sustainable economy. B Corporations mobilise profits and growth for a greater impact on their employees, communities and the environment, and we wanted to be part of that.

Accreditation was not easy, but that is part of the point. We believe that any credible move towards net zero is revolutionary to any business, and costs time, investment and imagination. In some cases it will mean finding the courage to admit that an organisation is falling behind and a frank discussion on what the remedy should be. But thinking in terms of Participation, Proof and Promotion offers a triple lens through which you can challenge and power your progress.

If you seek a partner who will have credibility with your executive team, the courage to constructively challenge them and a no-nonsense approach based on your current business issues, then please contact us. Positive Momentum consultants are all former business leaders. We understand your day-to-day because we’ve lived it. We have no career consultants, no junior teams seeking spurious billing hours and no patience with time-wasting academic exercises. We’re practitioners, pragmatists and partners.